Introduction

The neobanks have already managed to shake up the financial market by offering smooth mobile experiences, minimal account fees, and an excellent customer support team. They demonstrated that a beautiful user experience can be used to make mass adoption. But it is not enough to have a beautiful front end but a slow clunky back end.

To founders who are developing MVPs or companies who are updating old systems the speed of the cash flowing under the hood has become the new bottleneck. The current dynamic financial world cannot allow businesses to wait days to clear their funds, which limits expansion, burdens business cash flows, and prevents additional revenue model.

Moreover, the final strategic differentiators are the speed of settlement and the cost of transactions. This is the reason why neobanks are becoming programmable financial platforms and are highly speedy, flexible, and composable with or without the support of a capable Blockchain Development Company that can comprehend the current financial infrastructure.

It is in this area that dollar-to-stablecoin swaps are required. Neobanks fraudsters will be able to access the fast global access and the programmable nature of the Web3 economy by allowing users to convert traditional US dollars into a digital dollar (a stablecoin) directly on the platform. This underlining capability also provides T+0 speed of settlement, which the contemporary global economy is gainfully requiring.

White-Label Neo Banking in 2025: The New Baseline

Today, white-label neobanking is far more than just offering branded accounts or debit cards. It’s a modular stack that allows fintechs, SaaS platforms, and enterprises to embed financial capabilities directly into their products.

At its core, a modern white-label neo bank includes account management, ledgers, payments, compliance workflows, and APIs to integrate seamlessly into your existing systems. This model allows founders to launch faster and enterprises to innovate without rebuilding regulated infrastructure from scratch.

However, legacy fiat rails can lead to friction at scale. Batch settlement, multiple intermediaries, and fragmented cross-border systems slow product velocity and increase the operational costs for businesses.

Furthermore, as transaction volumes grow and business models become more complex, it becomes almost impossible to ignore these limitations. This is why many platforms are rethinking their foundations and looking toward stablecoins as a more flexible settlement layer.

Dollar-to-Stablecoin Swaps Explained (Without the Noise)

A dollar-to-stablecoin swap is a process where fiat dollars can be converted into tokenized digital dollars, typically directly backed by reserves. From a technical standpoint, you can easily move your funds from traditional banking rails to a custody layer and then issue them as on-chain tokens that can be transferred instantly.

Unlike traditional fiat settlement, which takes days and involves multiple clearing steps, you can complete your stablecoin settlements nearly in real time. This difference can fundamentally change how products are designed and scaled. Payments become atomic, auditable, and programmable.

Why Dollar-to-Stablecoin Swaps Are Becoming Essential

1 Faster Settlement and Better Unit Economics

Being able to settle transactions faster gives many businesses immense cash flow flexibility. Instead of waiting T+2 or longer for funds to clear, you can have immediate access to capital. This will reduce your working capital requirements, improve liquidity in the business, and strengthen your margins.

For business owners and leaders focused on ROI, this speed translates into better unit economics. And over time, these gains will compound across key metrics like LTV and CAC.

2 Global Payments Without Banking Friction

Cross-border payments remain one of the most painful areas of traditional banking. With multiple intermediaries, FX markups, and inconsistent settlement times, overall, it becomes a fragmented experience for global users.

But dollar-to-stablecoin swaps can help you simplify this complexity. Once funds are on-chain, you can easily move them globally without needing any correspondent banks or region-specific rails. This can be especially valuable for SaaS platforms, marketplaces, and Web3 products with international user bases. In this context, you can say real-world assets, such as tokenized dollars, can become a universal settlement medium rather than a regional constraint.

3 Programmable Money as a Product Unlock

Beyond speed and reach, programmability is the real breakthrough. You can easily embed stablecoins into smart workflows and automate payouts, escrow, subscriptions, and revenue sharing.

This will allow product teams to design financial features that were previously impractical or expensive to make. Furthermore, with capabilities such as usage-based billing, instant creator payouts, and automated compliance checks, your business can achieve unparalleled reach. Here, stablecoins act as building blocks for innovation rather than just payment instruments.

If you are exploring how programmable money could unlock new product features or revenue models, contact us for a custom quote to assess feasibility and architecture.

Why This Capability Belongs Inside White-Label Platforms

One common mistake that many business owners make is treating stablecoin support as an add-on or a side wallet. Instead, stablecoins should function as a first-class ledger primitive within white-label platforms.

This approach enables B2B2C scale. This can empower downstream fintechs, SaaS products, and marketplaces to leverage stablecoin rails without exposing blockchain complexity to end users. Besides, account abstraction, particularly ERC-4337, plays a critical role here, as it helps in hiding gas fees, simplifying onboarding, and delivering a Web2-grade experience.

As more and more transactions move on-chain, real-world assets like tokenized dollars can become deeply integrated into everyday workflows, and white-label platforms that embed this capability early can gain a structural advantage.

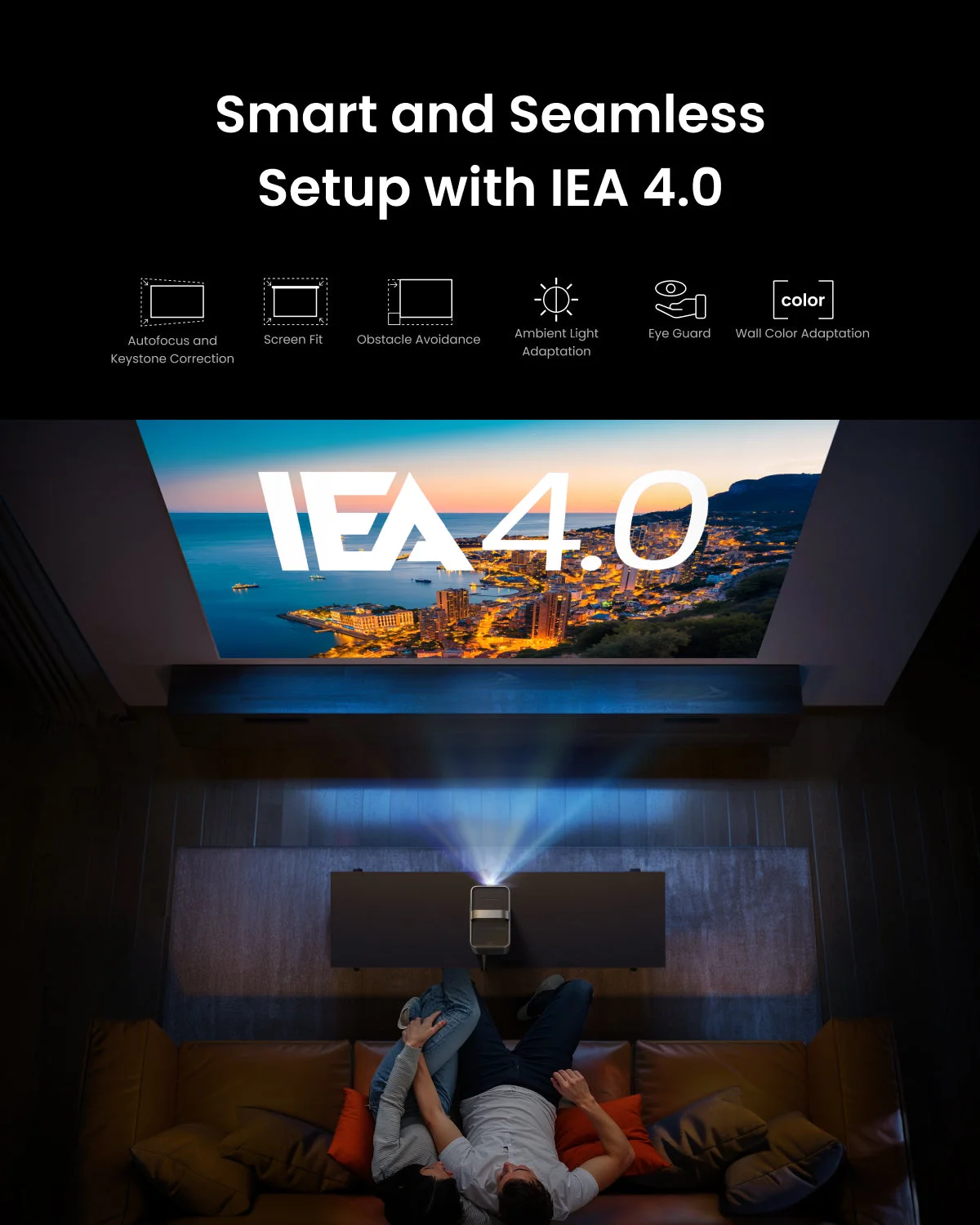

Technical Architecture: How Dollar-to-Stablecoin Swaps Are Built

- Under the hood, dollar-to-stablecoin swaps rely on a carefully orchestrated architecture. Here, fiat funds enter through traditional rail and are held with regulated custodians. Once they’re verified, the corresponding stablecoins are issued on-chain and reflected in internal ledgers to maintain consistency.

- Smart wallets, enabled by account abstraction, can manage user interactions while abstracting blockchain mechanics. This allows enterprises and business owners to enforce permissions, recovery rules, and transaction policies without compromising user experience.

- Layer 2 rollups are essential for scalability. These L2s help process transactions off the main chain and settle in batches, reducing the overall costs while maintaining security. This also helps make high-throughput applications economically viable.

- ZK proofs add a critical layer of compliance. They allow platforms to verify identity, balances, or transaction validity without exposing sensitive data. This balance between transparency and privacy is key for mass enterprise adoption and regulatory alignment.

AI’s Role in Making This Infrastructure Scalable

As transactional volume grows, operational complexity will increase. This is where AI plays a crucial role in keeping systems efficient and resilient. LLM agents can automate reconciliation, compliance reporting, and exception handling, reducing manual overhead.

Real-time AI models can enhance fraud detection by analyzing patterns across both fiat and on-chain activity. This proactive approach can lower loss rates and strengthen trust.

Besides that, edge functions can further improve performance by executing logic closer to users. For global platforms, low-latency interactions are essential to deliver a seamless financial experience. With AI and edge computing together, stablecoins can be scaled reliably within production-grade systems.

Business Impact for Founders and Enterprises

For business leaders and executives focused on growth, they can directly measure the value of dollar-to-stablecoin swaps against the most critical SaaS metrics.

Impact on AARRR Metrics and Platform Adoption

- Acquisition/Activation: They’re a powerful acquisition hook, as they offer instant and low-cost global payment settlements. The faster settlement can reduce the time-to-value for new users, leading to higher activation.

- Retention/Referral: The superior UX, cost savings, and 24/7 availability help drive customer loyalty, in turn boosting customer retention.

LTV/CAC Improvement Through Faster Activation and New Revenue Models

- Higher LTV (Lifetime Value): The programmable features, like escrow, smart payroll, and instant treasury, increase customers’ dependency on the platform, turning a transactional relationship into a foundational one, significantly increasing LTV.

- Lower CAC (Customer Acquisition Cost): Superior product features in a competitive market make it cheaper to acquire and retain customers, leading to a massive improvement in the LTV/CAC ratio.

Why Building This Into MVPs Avoids Costly Re-Architecture Later

New founders and business owners who are trying to build MVPs, especially in AI or Web3, often defer core financial infrastructure. But by integrating stablecoin rails now into their systems, they can easily build a future-proof foundation. Attempting a complex enterprise integration to migrate from fiat-only to a hybrid fiat/stablecoin system years later can be exponentially more complex and expensive. Build it right from the start.

Regulation, Reality Checks, and When Not to Use Stablecoins

Despite their many advantages, stablecoins are not yet a universal solution. As a business, you must carefully evaluate everything before making a complete switch, as regulatory frameworks vary by region and compliance requirements differ.

Besides, for some use cases, particularly those with low transaction volume or purely domestic scope, traditional rails are still a better option.

The key here is pragmatism. You, as a business, must adopt dollar-to-stablecoin swaps if they can help your business in terms of speed, cost, or product capability and drive measurable value. Furthermore, for organizations and industries looking to seamlessly navigate regulatory considerations, stablecoins can be a powerful complement to existing systems.

Conclusion

Dollar-to-stablecoin swaps are no longer experimental features reserved for crypto-native startups. They are now a table stake for white-label neobanking platforms that aim to scale globally, innovate faster, and deliver superior unit economics to their clients.

Furthermore, ignoring programmable money can be a strategic risk. As competitors adopt more flexible settlement layers and move away from slow legacy systems, platforms that fail to evolve will struggle to keep pace in an increasingly volatile market. This is why founders, CTOs, and product leaders are increasingly partnering with aBlockchain Development Company to treat stablecoins as core infrastructure rather than optional enhancements.

Ready to explore how dollar-to-stablecoin swaps can strengthen your neo-banking platform or MVP? Get in touch with our team to discuss architecture, timelines, and next steps.